Last month was very interesting, with my grandmother’s car being stolen. It took an enormous amount of time to deal with the insurance, the paperwork, getting the car back, etc. They still haven’t told us if they have a definite culprit, but that’s another story for another day. This month hubby broke his foot. The first trip to urgent care showed no fracture, but when he came home and put the foot rest down on the recliner, he heard a pop, and the foot had a clean break. After a trip to the orthopedist the next morning, they decided surgery was his best option and scheduled him for the next morning.

Since this was hubby’s first surgery, we weren’t sure of his reaction to anesthesia. He came out of surgery with a fever of 102+ and apparently those chills he felt going in weren’t nerves, but a horrible virus. Combined with the virus and anesthesia, he started vomiting the night of the surgery, and that continued for over 24 hours. At this point, we decided a trip to the ER was in order for iv fluids, and he was able to get some Zofran via IV. However, the next day he was back to being nauseated. I decided to use all the Young Living essential oils I could for nausea and vomiting, and he was totally better in about thirty minutes. After kicking myself for not oiling him sooner (and saving myself a $150 ER visit co-pay), he finally found relief and started eating that night.

He will now be off work for a total of at least eight weeks. This is where I’m so glad we prepared financially for this type of situation. We have been paying on disability insurance for a long time, and we finally were able to access the benefits carrying that policy. While we won’t make his entire salary, it will still definitely be enough to get us through. I’m also so grateful to have our Family Binder, which includes our Financial Freedom Plan and our Insurance Info printable. It wasn’t hard for me to find the information that I needed. I’m also so glad we had our Flexible Spending Account to offset medical expenses as well.

I will admit that saving money has been very difficult, but with our taxes back, and I will be getting back-pay from an updated teacher’s contract, we will have a nice lump sum to put towards a new car. We continue to live as frugally as possible!

Debt Payoff Update for April 2016

How we made changes this month to save and earn extra income while we are spending as little as possible:

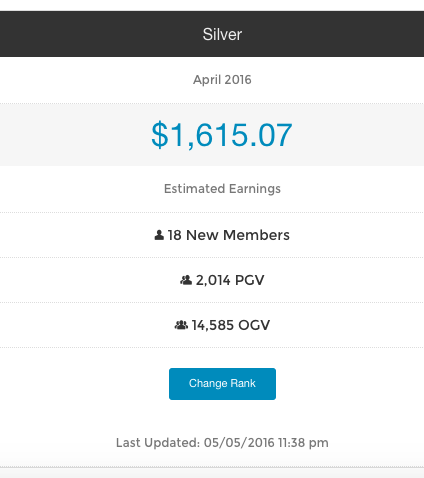

- We are actually at a point with our Young Living Essential Oil business, that my husband would no longer need to work. As you can see above, our income was over $1600 for April. We are also helping other couples achieve financial freedom with their Young Living Essential Oil business. If you have more questions about how to start your own business with us, please email me at steph (at) debtfreespending (dot) com.

- We had no paying photography sessions in April, since we have devoted all of our extra side-hustle time to building our Young Living Essential Oil business.

Prayer Requests & Praises:

- PRAISE! My dad did not have to have surgery! If you read in our March update, he was supposed to have his groin stented, but the Lord provided a healing, and the doctor told him to go home the morning of the surgery! What a huge praise!

- We are still praying about moving forward with possibly having another child. We have completed the pre-transfer (we have four frozen embryos) testing process, and now we are just waiting on the Lord to give us a complete green light to move forward.

- Pray that the Lord will allow our vehicles to last as long as possible. We have decided not to get the van fixed at this point, because the amount of money we would have to put in to fixing the transmission would not be worth the cost.

- We are thankful that we have the disability insurance and the income from our side hustles to get us through this time of my husband not working.

Leave a Reply