A little over two years ago I wrote a blog post titled Why I’m Keeping My Eleven Year Old Van and had no plans of getting an auto loan. Hubby and I have only ever had one short-term auto loan in our seventeen years of marriage. However, in the fall after the transmission went in our van a second time, I fell victim to the ego monster and purchased a car with an auto loan. Now, don’t get me wrong, we could easily afford the payments, and for two years I drove the car and loved all the features…. until my son was born four months ago.

A little over two years ago I wrote a blog post titled Why I’m Keeping My Eleven Year Old Van and had no plans of getting an auto loan. Hubby and I have only ever had one short-term auto loan in our seventeen years of marriage. However, in the fall after the transmission went in our van a second time, I fell victim to the ego monster and purchased a car with an auto loan. Now, don’t get me wrong, we could easily afford the payments, and for two years I drove the car and loved all the features…. until my son was born four months ago.

Check out our Debt Reduction Plan with FREE Printables!

Having a child drastically changes your outlook on your time, finances, and attitudes. I realized I didn’t want both my husband and I to have to work full-time. We had also acquired a small loan towards our in vitro cycle, even though we had paid them many thousands of dollar in cash. Our third loan is the remaining student loan from when my husband became a nurse several years ago. Once our son was born I realized we would be in debt for at least another four years, unable to apply extra towards the debt because of the added expenses a new baby brings. Please keep in mind that two years ago when we bought the car I didn’t dream that I’d ever be pregnant. We had been married over 15 years at the time and already had one failed in vitro cycle. So when we purchased this car I never thought I’d have daycare expenses within two years! This is another reason why debt is never a good thing….because we can’t predict our future!

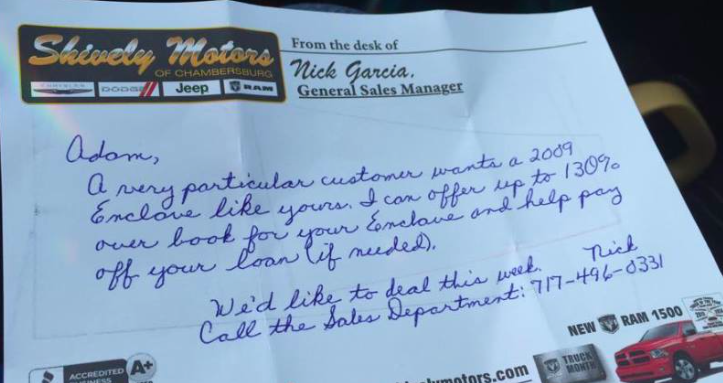

Columbus Day rolled around this past week and so did all the sales at the car dealership. One of our local dealerships contacted us about their buy back program, where they would give us 130% of the car’s value, as you can see pictured above. At first we couldn’t figure out why anyone would want to buy our car, when we later realized it was a gimmick (after several friends shared their letters as well on Facebook). Here’s the rub, we didn’t want to trade-up. We just wanted to get rid of the car payment…period. We decided to still venture into the dealership, expecting them to tell us they would not buy back our car.

They offered us 130% on the spot, and I knew that our car was not worth that after checking the Kelly Blue Book price. So, later the general manager of the dealership called me to tell me that the person wasn’t interested in buying our car anymore. Since I run a blog and understand FTC regulations, I was able to find a loophole in their advertising approach. They hadn’t disclosed anything about requiring a trade-up. This dealership actually sent this letter to many, many people in our local area and never added any kind of disclosure anywhere on the card. In fact, it looked hand-written, and many people probably didn’t think it was an ad, because it truly looked like a card from the general manager personally. After I had to explain that I would be calling the local media outlets about how shady this was, we were able to settle on an agreeable price, and we sold them our car. $20,000+ in debt…gone.

I immediately came home and revised my Debt Reduction Plan, and we should now be able to be debt free (other than our mortgage) by June of 2015! I can’t express how excited and happy I am and so excited that we can all be on this journey together!

Check out all of our other Finance articles!

How I Eliminated $20,599 in Debt in One Day

10 Ways to Start Saving Money Today

15 Things You Should be Buying at the Dollar Store

10 Tips for Building An Emergency Fund

How Couponing Saves Me $7,000 Per Year

Create A Gift Closet & Save Money

Starting a Stockpile Can Save You Money

Three Tips to Rebuilding Your Credit

Leave a Reply